We appear to be entering another period of political and economic uncertainty. Where federally-imposed monetary policy is not producing the desired economic growth, rising employment, and investor returns. Add to this a marketplace where both goods are services are becoming commoditized. Where branding, once the shorthand proxy for quality, is rapidly being overcome by abundance, choice, and reduced prices until the brand is almost indistinguishable from the knock-off. Where the prestige or badge value of a particular name no longer serves as a means of status signaling for people who simply don’t care who made your goods or provided services. A trend exacerbated by the outlet stores that sell branded merchandise at reduced prices – even full well knowing that there may be a lower quality of goods found in the outlet stores. Or even worse, finding out that your store’s private label merchandise was made on the same assembly line as the branded version.

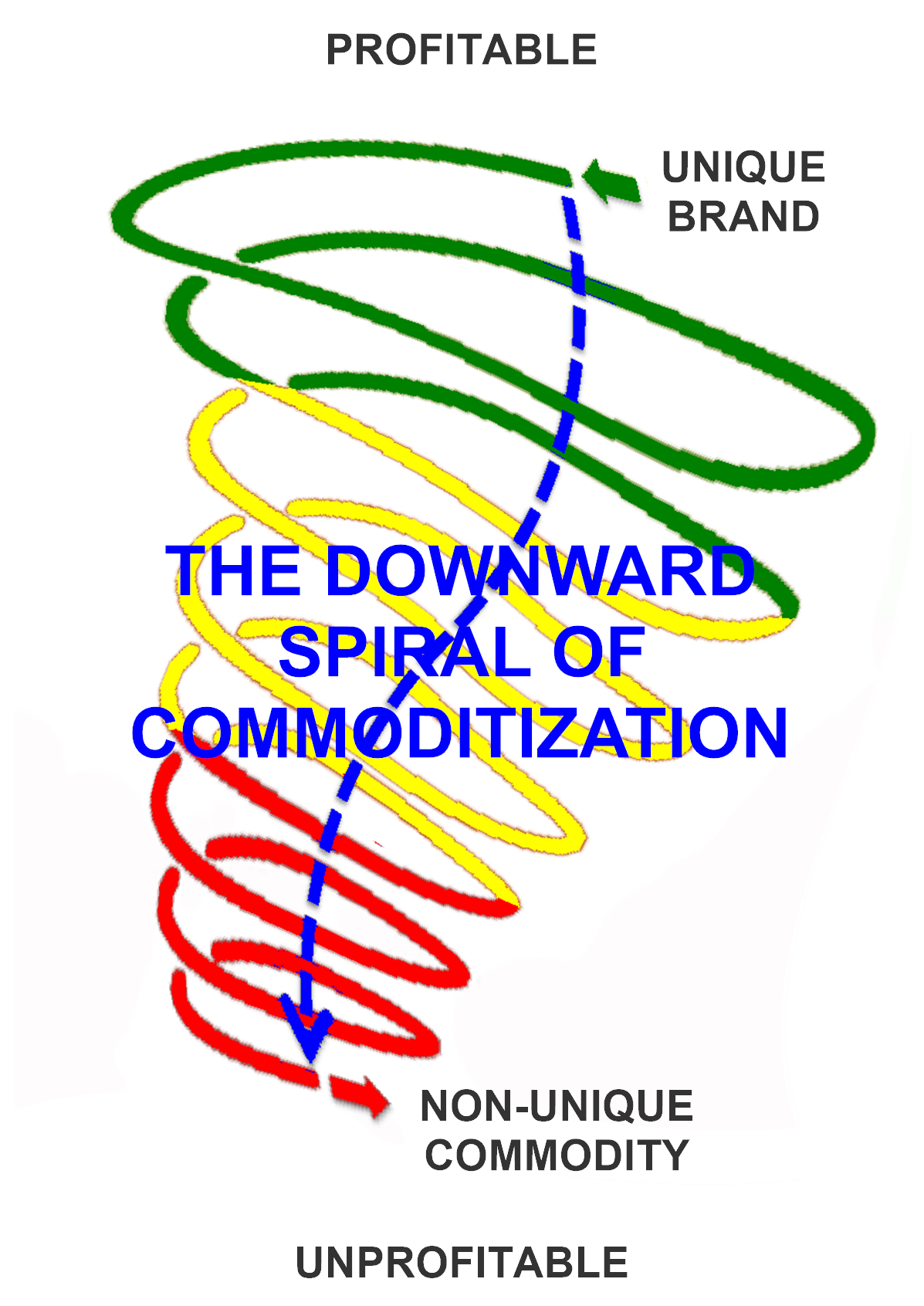

Enter the world of change, where worldwide competition, a wide variety of choices, and overabundance is driving margins and profits lower.

The traditional method of fighting commoditization such as re-skinning core products, adding product enhancements, and features, lowering production and administrative costs, and reducing customer service is not always enough. Through platforms such as Amazon, we are awash in the seas of sameness, where other-branded merchandise, often from foreign producers, is available at a lower price point. And, the consumer doesn’t seem to care – particularly when the product cannot be seen by others.

What does this mean for employees? It is time to evaluate your company’s susceptibility to commoditization as management’s preferred response is often to eliminate the product or reduce personnel costs to compensate for declining profits.